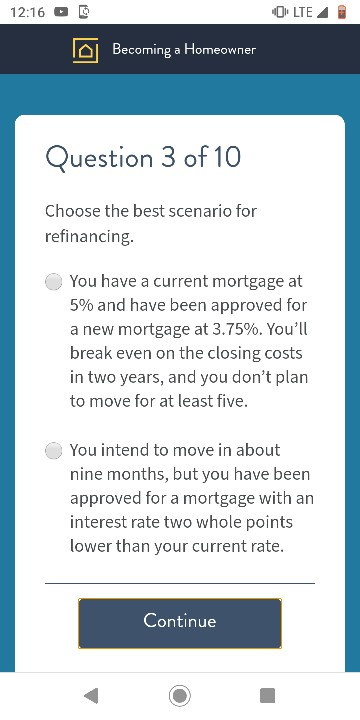

choose the best scenario for refinancing answer

Youll break even on the closing. You have a current mortgage at 5 and have been approved for a new mortgage.

5 Essential Questions To Answer Before You Refinance Your Mortgage

The lower interest rate drops your monthly payment from 1013 to 898 a savings of 115 per month.

. Question 3 Of 10 Choose The Best Scenario For Refinancing. A You have a current mortgage at 5 and have been approved for a new mortgage at 375. If you have an.

So whats the right answer. Choose the best scenario for refinancing. You have a current mortgage at 5 and have been approved for a new mortgage at 375.

Choose the best scenario for refinancing. The best scenario for refinancing. THIS IS THE BEST ANSWER.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. You have a current mortgage at 5 and have been approved for a new mortgage at 375. Question 3 of 10 Choose the best scenario for refinancing.

You have a current mortgage at 5 and you are approved for a new mortgage at 375. Choose the best scenario for refinancing Choose the best scenario for refinancing. Best case scenario for refinancing.

Apr 01 2022 0532 PM. Answer - Choose the best scenario for refinancing. The best time to speak with an HFA is at the beginning of your mortgage journey or anytime you would like assistance or advice determining the best path forward in property.

You have a current mortgage at 5 and have been approved for a. Choose the best scenario for refinancing. Interview questions and answer.

2 on a question. Choose questions that fit the mood of the people and the place youre asking. The best scenario for refinancing.

3 on a question. Choose the best scenario for refinancing. You have a current mortgage at 5 and have been approved for a new mortgage at 375.

The best scenario for refinancing. Youll break even on the closing. You have a current mortgage at 5 and have been approved for a new mortgage at 375.

Question 3 Of 10 Choose The Best Scenario For Refinancing. Youll break even on the closing costs in two. Choose the Best Scenario for Refinancing.

Well it depends on your specific situation. Youll break even on the. Youll break even on the.

Primarily multiple choice questions can have single select or multi select answer options. Choose questions that fit the mood of the people and the place youre asking. Youll break even on the.

Choose The Best Scenario For Refinancing Homeworklib A recent NFCC and Wells Fargo survey may have your answer. Sales interview questions the ultimate. You have a current mortgage at 5 and have been approved for a new mortgage at 375.

Choose the one alternative that best completes the statement or answers. By William K August 22 2022 10 views. The best scenario for refinancing.

You have a current mortgage at 5 and have been approved for a new mortgage at 375. Choose the best scenario for refinancing. You have a current mortgage at 5 and have been approved for a new.

Youll break even on the closing costs in two years and. Youll break even on the. Choose the best scenario for refinancing.

Choose The Best Scenario For Refinancing

List 10 Choose The Best Scenario For Refinancing

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

How Interest Only Mortgages Work Pros Cons Nerdwallet

Cash In Refinance What It Is And If It S Worth It Quicken Loans

Should I Refinance Or Consolidate My Student Loans Experian

How Does Student Loan Interest Work Student Loan Hero

Highest Home Values In 40 Years Could Mean A New Home In Your Current Home Kansas City Business Journal

No Cash Out Refinance Vs Limited Cash Out Refinance Better Mortgage

Is Refinancing A Bad Idea Assurance Financial

Best Auto Refinance Companies The Sacramento Bee

Home Equity Loan Or Heloc Vs Cash Out Refinance Nerdwallet

How Soon Can You Refinance A Car Loan Space Coast Credit Union

Home Equity Line Of Credit Heloc Vs Refinancing What S Best For Me American Heritage Credit Union

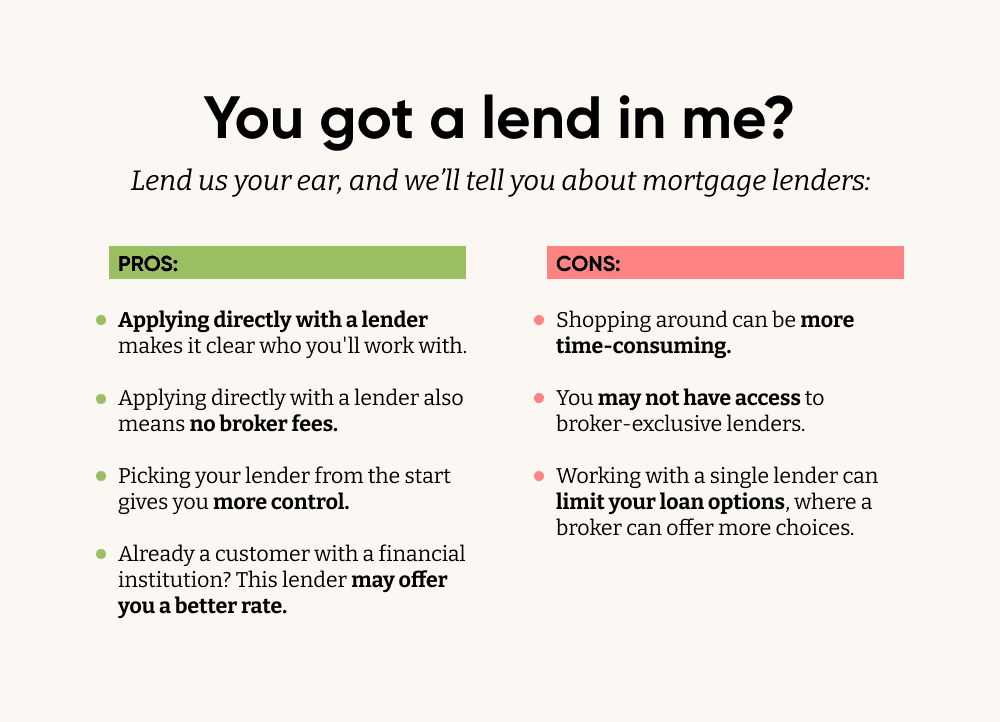

Mortgage Brokers Vs Mortgage Lenders What S The Difference Morty

What Does A Mortgage Loan Officer Do To Help Me Buy A Home Or Refi

Mortgage Refinance Volume Plunges 80 But Could You Benefit From A Refinance Today